By Harold V. Kane

Harold V. Kane

Did President Donald Trump inadvertently give the New Jersey Republicans a gift horse? It is no secret that the cap of $10,000 on the deduction for state and local taxes (SALT) will hit many Garden State residents hard. Many residents of the Hudson County Gold Coast are paying $20,000 to $30,000 in property taxes plus New Jersey income and sales taxes, and New York City and state income taxes. These residents are used to taking the full SALT deduction from their federal taxes and often receive a tax refund from the Treasury. Now there is a high probability that these people will be sending a check to the Treasury instead of receiving one. Some will blame the president for the additional tax liability, but the national tax laws have to be applied equally. Where the changes hurt New Jersey they actually help Texas since Texas has much lower property taxes and no state income tax. So why is this a gift horse?

Read the rest of this entry »

Posted: December 17th, 2018 | Author: admin | Filed under: Harold Kane, Harold V. Kane, New Jersey, Opinion, Property Taxes | Tags: Harold Kane, Harold V. Kane, New Jersey, Opinion, property tax reform, SALT deduction | 4 Comments »

Andrew Sidamon-Eristoff In politics, being seen to do something is almost as important as actually doing it. So it was perhaps inevitable that aggrieved blue-state leaders in California, New York, and now New Jersey would push half-baked ideas for thwarting or working around the recent federal tax bill’s “devilish” limitation on state and local tax (SALT)… Read the rest of this entry »

Andrew Sidamon-Eristoff In politics, being seen to do something is almost as important as actually doing it. So it was perhaps inevitable that aggrieved blue-state leaders in California, New York, and now New Jersey would push half-baked ideas for thwarting or working around the recent federal tax bill’s “devilish” limitation on state and local tax (SALT)… Read the rest of this entry »

Posted: February 12th, 2018 | Author: admin | Filed under: New Jersey, Opinion | Tags: Andrew Sidamon-Eristoff, New Jersey, Opinion, SALT deduction | 1 Comment »

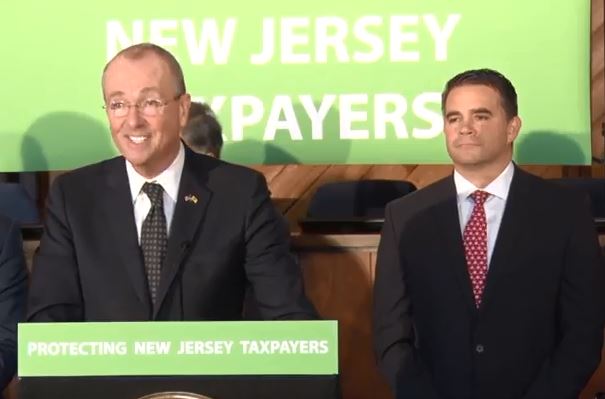

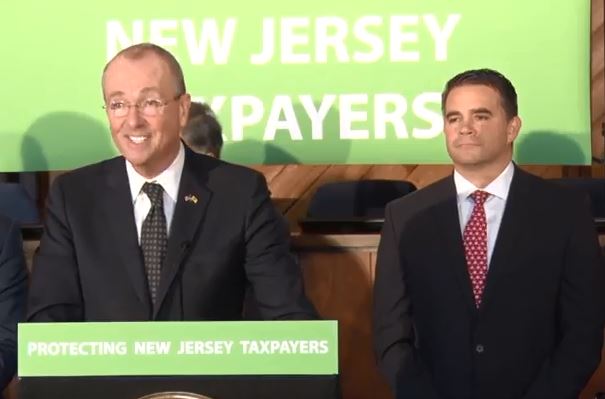

Marlboro, NJ-With Belmar Mayor Matt Doherty looking like Chris Christie standing behind Donald Trump on Super Tuesday — and four other Democrat mayors standing behind him, Governor Phil Murphy today declared he had bi-partisan support for his plan to have the state’s municipalities set up charities to accept donations in lieu of property taxes. Murphy said that the recent income tax reform passed by Congress and signed into law by President Trump is a tax increase on New Jersey’s middle class. The scheme he is proposing would, if allowed by the IRS, reverse the impact of the tax reform law’s $10,000 cap on the state and local tax (SALT) deduction.

Read the rest of this entry »

Posted: February 9th, 2018 | Author: Art Gallagher | Filed under: Monmouth County News, New Jersey, Phil Murphy | Tags: Belmar Mayor Matt Doherty, Chris Christie, Congressman Leonard Lance, Declan O'Scanlon, Donald Trump, Governor Phil Murphy, Income taxes, Jon Hornik, Matt Doherty, Monmouth County News, New Jersey, NJ Property Taxes, SALT deduction, Sen. Joe Pennacchio, Senator Declan O'Scanlon, Shaun Golden, Sheriff Shaun Golden | 2 Comments »

Gov Phil Murphy and Marlboro Mayor Jon Hornik

Governor Phil Murphy will be in Marlboro Township on Friday for a press conference about his scheme to allow property tax payments to be classified as charitable contributions for federal income tax purposes.

The tax reform law passed by Congress and signed by President Trump last December limited the deduction for state and local taxes to $10,000. All members of the New Jersey Congressional Delegation, with the exception of Rep. Tom MacArthur (R-NJ3) voted against the measure.

Read the rest of this entry »

Posted: February 8th, 2018 | Author: Art Gallagher | Filed under: Monmouth County News, New Jersey, Phil Murphy | Tags: Governor Phil Murphy, Marlboro Mayor Jon Hornik, Monmouth County News, New Jersey, Property Tax, SALT deduction | 12 Comments »

New Jerseyans who rushed to pay their 2018 property taxes before Dec. 31 won’t be able to deduct the expense from their 2017 state income taxes, the New Jersey Society of CPAs advised Thursday. While the IRS issued instructions last month that some 2018 prepayments are deductible from federal income taxes in 2017 if you’ve already… Read the rest of this entry »

New Jerseyans who rushed to pay their 2018 property taxes before Dec. 31 won’t be able to deduct the expense from their 2017 state income taxes, the New Jersey Society of CPAs advised Thursday. While the IRS issued instructions last month that some 2018 prepayments are deductible from federal income taxes in 2017 if you’ve already… Read the rest of this entry »

Posted: January 11th, 2018 | Author: admin | Filed under: New Jersey | Tags: New Jersey, New Jersey income taxes, SALT deduction, State and local taxes | 2 Comments »

Marlboro Mayor Jon Hornik

Marlboro Mayor Jonathan Hornik is asking the Township’s Council to support Governor-elect Phil Murphy’s proposal to allow New Jersey residents to make charitable contributions in lieu of property taxes as an end around the tax reform legislation passed by Congress and signed into law by President Trump last year. The new federal tax law limits the deduction for State and Local Taxes (SALT) to $10,000.

Read the rest of this entry »

Posted: January 11th, 2018 | Author: Art Gallagher | Filed under: Jon Hornik, Marlboro, Monmouth County News, Phil Murphy | Tags: Federal Tax Reform, Governor-elect Phil Murphy, Marlboro Township, Monmouth County News, Phil Murphy, Property taxes as charitable contributions, SALT deduction | 4 Comments »