Property Tax Appeal Attorney Responds to Gopal’s Ignorance

By Kevin I. Asadi

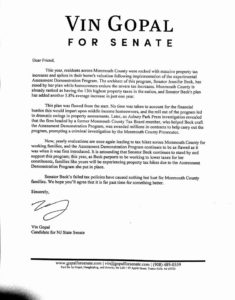

Monmouth County residents: I received this letter in the mail today from Vin Gopal. I’m sure he’s a nice guy, but a letter like this shows such a gross and shocking misunderstanding of how property taxes work, that I fear what damage he might do to all of us, should he win.

I handle property tax appeals as part of my law practice. Here is how it works, basically: the property you own is given an assessed value by the local tax assessor or by a revaluation company. In most counties, that assessment will remain the same year after year, until the town decides to perform a revaluation or a reassessment.

Whether your assessed value is $100,000 or $1,000,000, either way, your town needs a certain number of dollars in the kitty each year in order to operate. Take the amount of money the town needs divided by their total assessments, and the quotient is called the “general tax rate.” The property tax dollars you pay is the product of your assessed value times the general tax rate.

Most of the time, it can be well more than 10 years between assessments, even though the real estate market values might increase or otherwise change dramatically during that time. Because of this, assessors have to certify to their town’s “equalization ratio” every year. This ratio is, basically, a fraction, the numerator of which is the total assessments in town and the denominator of which is the fair market value of all of that assessed property. Thus, a property’s “implied value” is the assessed value divided by the equalization ratio. If you can prove your property’s fair market value is 15% less than your implied value, then you could win a tax appeal.

Let’s look at an example. When I first started doing this, the equalization ratio in Asbury Park was around .20. This means, on average, property in Asbury Park was assessed for 20% of its fair market value. Meanwhile, I had a client who purchased a fancy condo in Asbury for around $900,000. His assessment was around $500,000. I told him to appeal. At first he thought I was nuts. He thought he was getting away with murder! Only after I explained the above did he realize how severely over-assessed he was. I was able to save him many thousands of dollars per year. How long was the prior owner getting ripped off by the city? How many thousands of people similarly thought they were under assessed when in reality they were seriously *over* assessed? The answer is, unfortunately, very many.

Most people are not tax appeal lawyers. Most people do not understand this. Why would they? It’s complicated, and convoluted.

The Monmouth County Pilot Program sought to simplify this. Now It’s easy. Think of your equalization ratio as 1.0, or 100%. If your property is worth less than your assessed value, you win! That simple. No more implied value or other layers of confusion. Did people’s assessed values go up? Mostly, yes. So what!

“OH MY GOODNESS! MY ASSESSED VALUE WENT UP FROM $150,000 TO $300,000! MY PROPERTY TAXES DOUBLED, RIGHT?” Wrong.

The total dollars needed by the town to operate remains the same. Therefore the tax rate mathematically decreased. But people do not see their tax rate. They saw their assessed value rise, and some people flipped out without understanding. Mr. Gopal must have been among those people, unfortunately.

I hate to sound like a partisan operative because I’m really not. But I am compelled to mention that Mr. Gopal is a Democrat who cut his teeth in a political machine environment that has an extremely poor record for controlling property tax increases. I happen to own two properties in Monmouth County: one in Freehold Borough (100% Democrat governing body) and one in Freehold Township (100% Republican governing body). In 2017, my property taxes went up by an astounding $1800 in Freehold Borough. During the same period, my property taxes DECREASED by around $180 in Freehold Township. I don’t know if that has anything to do with Republican/Democrat differences or not, but since Mr. Gopal generated this mailer, I could not help but think about that.

If you truly care about controlling property tax increases, then I suggest you cast a vote in favor of Jennifer Beck, who co sponsored the Pilot Program and whose tax policy was hugely effective in tamping down the sort of tax increases I’ve paid for in Freehold Borough.

Kevin I. Asaid is practices law in Red Bank

This letter is a good explanation of the tax levy process, and does correct the false impression left by the Gopal letter.

But that next-to-last paragraph was a bit misleading. In my experience, large swings in taxes are the result of my assessment going up faster than the town average; that is beyond the control of municipal government. Changes in the size of the tax levy are only partially under municipal control. In Freehold Twp., 15% of the tax levy goes to the municipality; in Freehold Boro, it’s 35%. (The rest goes to schools, libraries and the county.) Also, loss of other funding sources can for a municipality to rely more heavily on local property tax. So only a small portion of any change in my taxes is the result of action by the municipal governing body. But Mr. Asaid is not wrong: according to 2017 User-Friendly Budgets, Freehod Twp. reduced property taxes for municipal purposes by 4.25%, while Freehold Boro increased by 4.73%

I object much more strongly to 2 statements in Mr. Gopal’s letter.

First: “Senator Beck’s plan has added another 5.8% average increase in just one year.” Simply false; the 5.8% increase comes from a higher need for property tax revenue, not from changing the way assessments are done.

Second: “…families like yours will be experiencing property tax hikes due to the Assessment Demonstration Program….” Incredibly misleading. Any reassessment will cause tax hikes for some families, but it will also cause tax decreases for some families. When assessments were only done once every 10 years or so, dramatic changes in assessed value commonly created big changes in tax bills. Under this new program, changes in assessed value will be frequent but small, creating fewer tax bill shocks.

Will the more-frequent reassessments in the new program result in lower taxes? No. Higher taxes? No. Fairer taxes? Yes.

Everyone keeps talking about taxes and raising revenue but I never hear anyone tryng to exercise fiscal responsibility like we do in a home or in a business and so forth. We do not or ever had a revenue problem we have a spending problem but we keep re-electing same knucklehead politicians on both sides of the party and are surprised when nothing happens or things get worse. Eventually big brother will run out of other people’s money.

we’ll soon have $millions$ more, in great new legal – pot taxes to blow, on more social programs that fix nothing, and create more problems that need subsidizing and repairing- but, give them time, NJ can’t even smoke themselves to death,or stay high enough, to not realize that once again, these idiots have wasted even that “great” new “revenue source,” too, because we have dozens of examples here, in other states, and plenty of other countries in this world, that once you fall into all-government, all the time, and forever-socialism, even the richest and most mighty of lands will, yes, go broke, and yes, fall.. “Liberty and Prosperity,” NJ’s state motto, is quickly becoming not just a sad joke, but a phony lie- it is simply only a matter of time..